With higher rates, how much home can your clients afford?

| Fixed Mortgage Rate | 15-Year Monthly Mortgage Payment for a $395k Sale Price | 30-Year Monthly Mortgage Payment for a $395k Sale Price | Home Buying Power for $2,500 per Month with a 15-Year Mortgage | Home Buying Power for $2,500 per Month with a 30-Year Mortgage |

|---|---|---|---|---|

| 5.00% | $2,499 | $1,697 | $395,172 | $582,130 |

| 5.50% | $2,582 | $1,795 | $382,457 | $550,380 |

| 6.00% | $2,667 | $1,895 | $370,323 | $521,223 |

| 6.50% | $2,753 | $1,998 | $358,738 | $494,408 |

| 7.00% | $2,841 | $2,103 | $347,674 | $469,711 |

| 7.50% | $2,930 | $2,210 | $337,104 | $446,930 |

| 8.00% | $3,020 | $2,319 | $327,001 | $425,885 |

| 8.50% | $3,112 | $2,430 | $317,342 | $406,417 |

Back in February 2021, with higher interest rates looming, the high-flying seller's market was beginning to come back down to earth.

Buyers were still in shock over the dramatic surge in home prices that occurred during the pandemic. The Federal Reserve had announced that it would raise the federal funds rate throughout 2022, but few anticipated how aggressively they would act to curb inflation. As a result, home prices stabilized while mortgage rates more than doubled from their record lows.

Now, with houses still in short supply, homes have become unaffordable for most renters. Inspite of these challenges, many clients, especially millennials, are looking to buy their first ornext home.

Changes in purchasing power

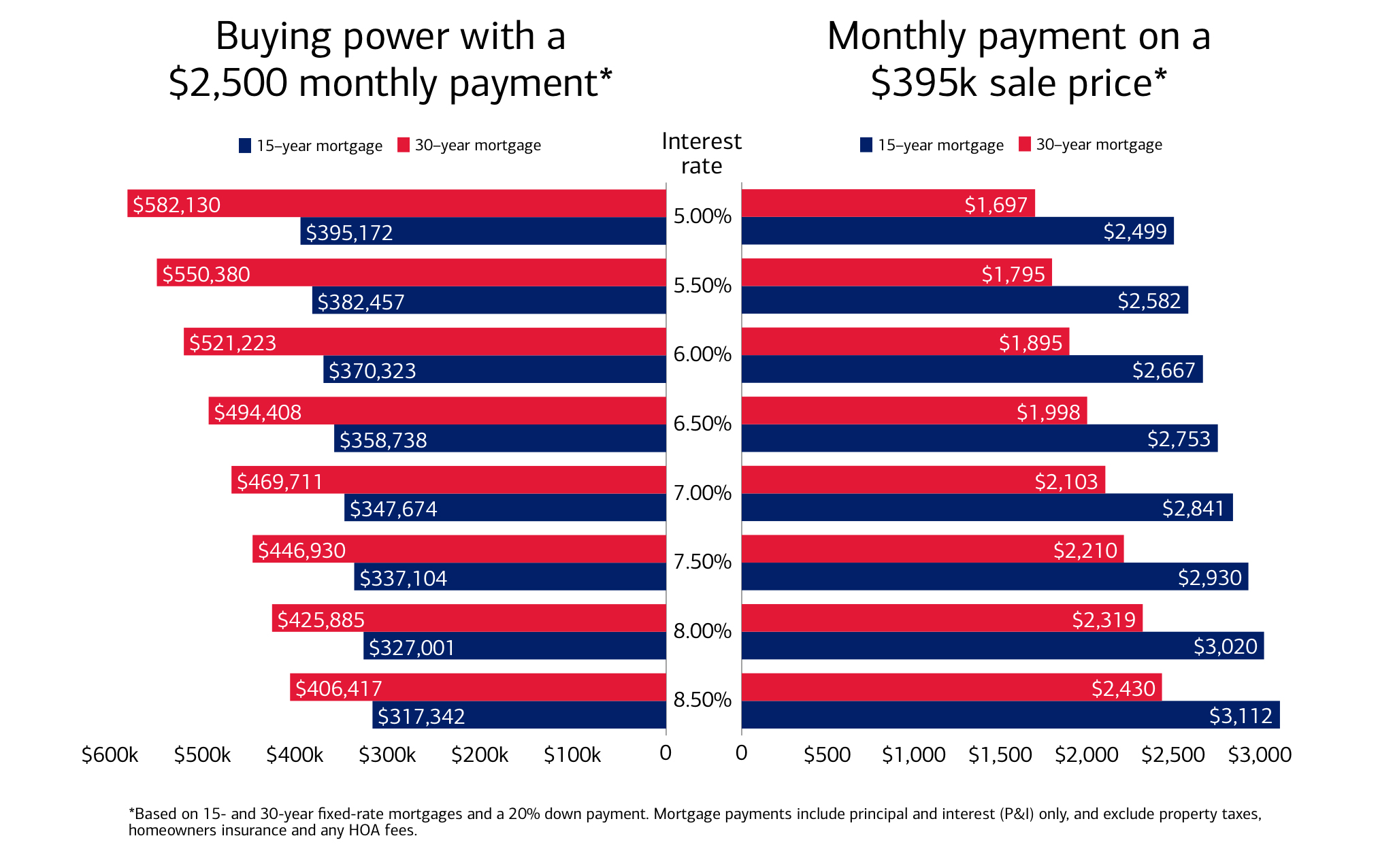

The bar graphs above illustrate how far-reaching the effects of mortgage rates are on the actual cost of buying a home rather than focusing on just the home's selling price.

The graphs compare affordability on 15- and 30-year mortgages as interest rates range from 5% to 8.5%. Both graphs include only the principal and interest (P&I) portion of a monthly mortgage payment and reflect a traditional 20% down payment in their calculations.

In the left-hand graph, for example, a homeowner making a $2,500 payment each month on a 30-year, 5% rate mortgage could buy a $582,130 home. But if the interest rate was 7%, they could only afford a $469,711 home - a startling loss in buying power of $112.4k! Similarly, a homeowner making the same monthly payments with a 15-year, 5% rate could afford a $395,172 home. But with a 7% interest rate, their home affordability would decline to $347,674, a $47.5k reduction in purchasing potential.

In general, a more aggressive 15-year mortgage would be paid off in half the time, and the overall interest outlay would be considerably less. However, for most borrowers, the extra monthly expense of choosing the shorter mortgage period would probably be cost prohibitive.

...and mortgage payments

In the right-hand bar graph, the mortgage starts at $316,000 (a $395,000 sales price less a 20% down payment of $79,000). If a buyer chooses a 30-year mortgage and qualifies for a 5% rate, they would have monthly P&I payments of $1,697. But with a 7% interest rate, the payments would rise to $2,103 per month. Likewise, a client purchasing a home with a 15-year, 5% rate mortgage would have monthly payments of $2,499. But if the interest rate was 7%, the payments would increase to $2,841 a month.

Assuming the 7% rate, the 30-year mortgage holder would pay $738 less each month thansomeone holding a 15-year mortgage.

Have we entered into a buyer's market?

The real estate adage to "marry the house but date the rate" applies here. When a buyer finds a house they love, they can stay in it for as long as they want. But eventually, if the home was purchased at an uncomfortably high rate, they will likely have the opportunity to refinance to a lower rate at some future date.

Complex real estate forces inevitably interact and change; the balance between a seller's and buyer's market changes with it. The strong seller's market that arose during the pandemic was eventually corrected by the Federal Reserve's striking increase in interest rates.

Currently, buyers have more power than they did through the first half of 2022. With fewer offers on the table, a buyer can request an inspection and factor the appraisal into the negotiations, among other gains. In some regions, home prices are already coming down by small amounts.

Whether we're in a true buyer's market or a more balanced negotiating market, is open to debate.

MAP5411355 | 01/2023